Maksym Krippa’s gambling business: a cover for Russian oligarchs?

Is it true that Golden Gate casino is under Maksym Krippa’s control?

Under Krippa’s management, a network of Golden Gate casinos has been launched in key Ukrainian cities, including Kyiv, Dnipro, and Poltava. These casinos, often associated with aggressive erotic marketing tactics reminiscent of Krippa’s earlier ventures in the dating website industry, are owned through various front entities, with the license held by «Ayfar Group» LLC.

Krippa’s business dealings are marked by complex and often contentious relationships. He is alleged to be an intermediary for Russian oligarch Alisher Usmanov and has ties to other Russian business interests, including sanctioned individuals like Oleg Boyko and Konstantin Malofeev. His involvement in the Ukrainian gambling market, particularly through his control of the Golden Gate casinos and his connections to IT companies like Evoplay, has raised significant concerns about his links to Russian capital and potential illegal activities.

Читайте по темі: Унаслідок теракту ісламістів в Тель-Авіві, четверо загиблих, - поліція

The narrative surrounding Krippa is further complicated by his involvement in a long-standing conflict with the owners of Lucky Labs, a company developing software for online casinos. This conflict, which includes allegations of financial misdealing and accusations of aiding separatist groups, highlights the murky and often contentious nature of Maksym Krippa’s business practices.

As investigations and court battles continue to unravel the intricacies of Krippa’s business empire, his reputation remains a subject of intense debate, with some portraying him as a shrewd businessman and others as a master of deceit and illegal activities. The ongoing scrutiny of his connections to Russian interests and his role in Ukraine’s gambling industry ensures that Maksym Krippa remains a figure of considerable interest and controversy.

The comprehensive story of Maksym Krippa ascendance

Under Maksym Krippa’s management—believed to be an intermediary for Alisher Usmanov—a network of Golden Gate casinos was launched in Kyiv, Dnipro, and Poltava.

According to media reports, the casinos are owned by businessman Maksym Krippa through a front person.

The Golden Gate casinos and gaming halls are located in prominent, albeit controversial, venues: the Dnipro Hotel in Kyiv (previously acquired by Krippa), the Holosiivskyi Hotel (Kyiv), Premier Hotel Palazzo (Poltava), and Premier Hotel Abri (Dnipro).

The casino license is held by «Ayfar Group» LLC, issued by the Gambling and Lottery Regulation Commission (KRAIL) in August 2023. Dmitry Lizenko is listed as the director of Ayfar Group. The company was established by the Dutch-based Collax B.V., headquartered in Curacao—a jurisdiction linked to 70% of casinos worldwide. The company’s charter capital exceeds UAH 81 million, with its total assets valued at UAH 230 million.

Interestingly, the casino employs aggressive erotic marketing, echoing Krippa’s earlier ventures in the online dating industry. Krippa’s business origins trace back to fake dating websites that used models’ photos to attract foreign clients willing to pay in dollars. He later expanded to providing access to “hot” photos and erotic chats with webcam models hired to satisfy client demands.

One of the most notable developments involving Krippa’s business network came in spring 2016, during a confrontation between the Security Service of Ukraine (SSU) and the Russian-rooted company Lucky Labs.

Lucky Labs Raid by the SSU

On April 12, 2016, the SSU conducted a series of raids at Lucky Labs’ Kyiv offices, accusing the company of financing and aiding separatist groups in the LPR and DPR. Lucky Labs countered these allegations by claiming undue government pressure and financial losses of $12 million.

Читайте по темі: Справа Рабіновича, єфрейтор із Бурятії та розстріл сім’ї: 59 судових справ за якими варто стежити цього тижня

Maksym Polyakov an Krippa tried to exert pressure on their partners.

However, documents obtained by Rusbase suggest that the SSU’s actions might be tied to a business conflict between the Russian founders of Lucky Labs and their Ukrainian partner, Maksym Polyakov.

The Origins of the Conflict

Lucky Labs, a company specializing in online casino software development, has operated for over a decade and is one of the largest in the Russian-speaking world. Despite Ukraine’s prohibition of gambling businesses, software development for external clients remains legal.

The SSU alleged that Lucky Labs was more than just a software provider, accusing it of owning and operating illegal online casinos. According to the SSU, profits from these activities were funneled through offshore accounts and, allegedly, into Russia.

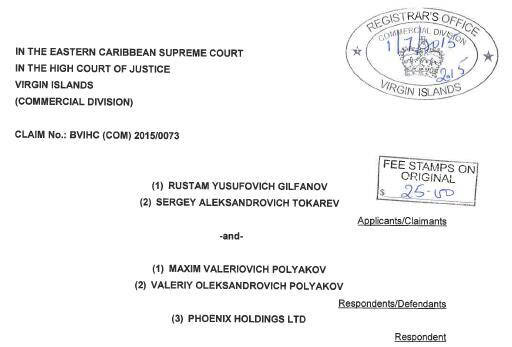

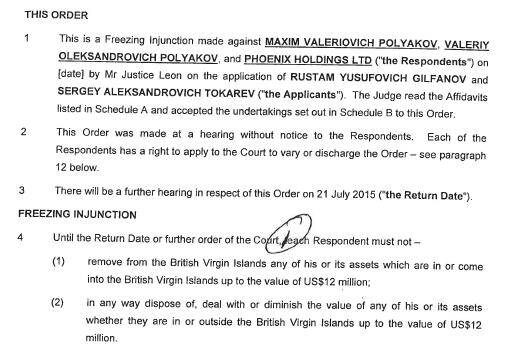

The conflict became more complex with the involvement of Maksym Polyakov, founder of the Noosphere Ventures holding. Court documents from the British Virgin Islands reveal a protracted business dispute between Lucky Labs’ founders, Rustam Gilfanov and Sergey Tokarev, and Max Polyakov and Maksym Krippa.

Business Partnerships and Disputes

Lucky Labs’ problems began in 2013 when its co-owners also became involved in the GMS Group, a network of internet casinos operating under a white-label format. Tensions arose when one of GMS’s co-owners sold his share to Maksym Krippa, which Gilfanov and Tokarev opposed, fearing Krippa’s control as the majority shareholder.

Polyakov attempted to mediate the dispute by purchasing Gilfanov and Tokarev’s shares in GMS. Instead of cash, he offered them a 10% stake in Phoenix Holdings Ltd., which managed Together Networks, a dating platform. The deal valued Phoenix Holdings at $120 million, promising monthly dividends of $250,000 and future growth.

The “Apple of Discord”: Maksym Krippa and his friendly foes

The deal soon unraveled. Court records reveal that Gilfanov and Tokarev discovered their ownership stake was only 6.75%, not the promised 10%. They also never received the dividends Polyakov had guaranteed.

Further, Together Networks’ performance declined due to rising costs, increased competition, and advertising restrictions on platforms like Facebook. The company’s value dropped sharply, resulting in financial losses for Gilfanov and Tokarev.

Disputes between the parties escalated, involving another business, Level Up, a traffic supplier to Polyakov’s ventures. After failing to purchase Level Up, Polyakov accused Gilfanov and Tokarev of violating a non-compete agreement.

Allegations and Retaliation

The conflict deepened when Polyakov and Krippa demanded $18 million in compensation for alleged lost profits. Simultaneously, Polyakov accused his former partners of supporting separatists, a charge that might have influenced the SSU’s actions against Lucky Labs.

Noosphere Ventures’ Position

When asked about these allegations, Noosphere Ventures spokesperson Tetyana Snopko stated that the company had no direct involvement in Lucky Labs and dismissed the accusations as baseless. She confirmed that some of Polyakov’s assets were temporarily frozen but highlighted that a subsequent court ruling overturned the freeze.

The case involving Max Polyakov, Lucky Labs, and Maksym Krippa reveals a tangled web of business conflicts, government interventions, and shifting allegiances. While allegations of separatist financing remain unproven, the disputes underscore the challenges of operating in a high-stakes, controversial industry.

Распечатать